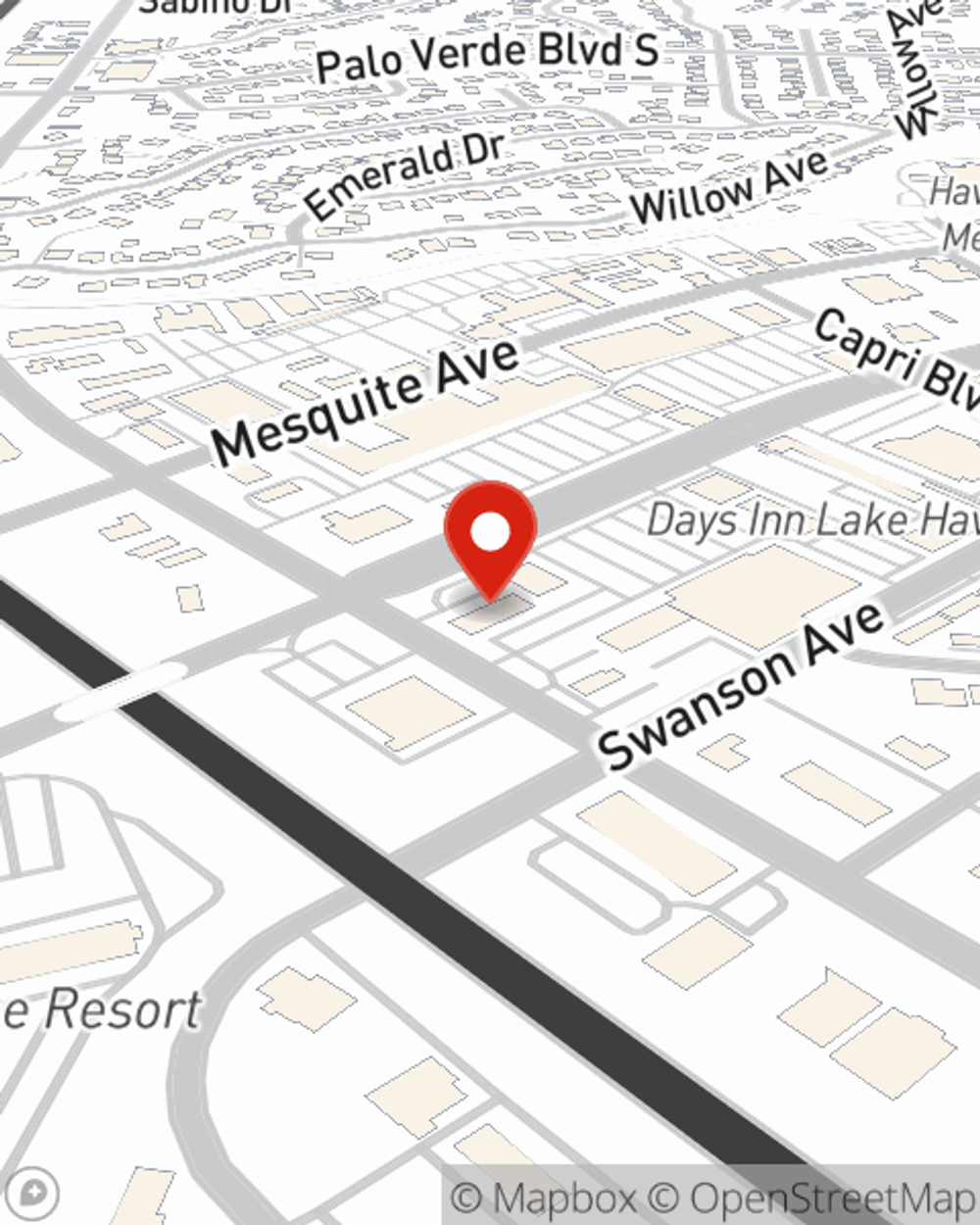

Life Insurance in and around Lake Havasu City

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It may make you uncomfortable to fixate on when you pass away, but preparing for that day with life insurance is one of the most significant ways you can demonstrate love to your loved ones.

Get insured for what matters to you

What are you waiting for?

Put Those Worries To Rest

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less stressful. Life insurance provides financial support when it’s needed most. Coverage from State Farm allows time to grieve without worrying about expenses like your funeral costs, college tuition or childcare costs. You can work with State Farm Agent Deborah J Miller to extend care for the people you're closest to with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

When you and your family are protected by State Farm, you might relax because even if the worst comes to pass, your loved ones may be protected. Call or go online now and see how State Farm agent Deborah J Miller can help you protect your future.

Have More Questions About Life Insurance?

Call Deborah J at (928) 854-6693 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Deborah J Miller

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.